Polyester prices plunge in early November, no support found

Polyester prices has been going through the downtrend having completed its busy season business. Both upstream and downstream players were looking at each other for support. But rapidly falling crude prices dampened these attempts by polyester players. Crude oil markets has been taking excuse of all factors that can pull down prices. Thus it appear that the oil market is entering the bear run. Further year closing has been playing its roll in winding up things, with just six weeks to go before the Christmas break and entering a New Year. In the week ending 9 November, polyester prices continued their fall with no respite seen unless favouring factors emerge.

Polyester fibre markets extended weakness in Asian markets with prices declining sharply in China and Pakistan while offers in India were already reduced last week. In China, buying appetite tapered, as sentiment turned cautious over volatile feedstock and crude oil prices. Offers were subsequently lowered to boost sales while PSF inventory levels climbed.

Polyester filament prices declined sharply in China, pressured by poor performance of crude oil and PTA and MEG price. Prices of POYs and DTYs were seen falling faster while the pace of decline was slower in case of FDYs. In Pakistan, DTY market saw thin transactions and overall demand withering. In India, due to the weakness raw material, local POY prices remained unchanged amid muted trading atmosphere.

Polyester spun yarn markets extended the weakness in China and prices fell further amid limited sales and drifting upstream cost of PSF. While yarn prices declined about 2% this week, PSF prices plunged more than 5% implying margins for yarn producers has expanded. In Pakistan, polyester yarn prices remained unchanged despite sharp cut in PSF, markets remained supported by higher imported yarn cost. In India, yarn prices rolled over but room for any increase is limited given the cut in November PSF price.

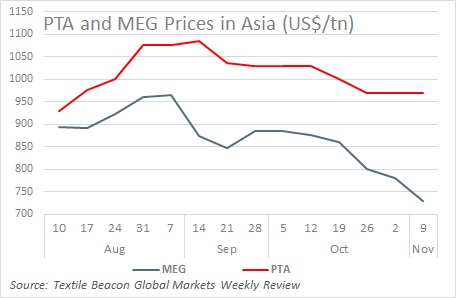

Upstream PTA prices did not move in Asia as downstream demand remained stagnant and upstream Px cost continued to retreat. In Europe, availability of spot PTA declined as the market shifted from tight to long in a matter of weeks. Downstream PET entered the low season and buyers held back, expecting deliveries of cheaper imports. In US, demand for PTA continued to soften amid seasonal downturn in the polyester chain.

Asian MEG prices fluctuated in weakness amid moderate trading sentiment. In China, November H2 and December values were higher than spot. Meanwhile, inventories increased 15%. European contracts were still not concluded, and was weighing on the market. In US, markets experienced downward pressure as supply was long and demand soft during the off-peak season.

Fibre chips of polyester prices declined in Asian markets in tandem with lower crude oil, PTA and MEG cost. However, margins were still positive and producers were active to offload goods. In Europe, due to low season, PET prices were under pressure. This was amid wave competitive offers from Asia. In US, PET market was poised for decreases in the next few months as key price drivers turned bearish while consumption began to ease with the start of cooler weather.

(Source: Global Markets Weekly Review. For full report write to us at sales@textilebeacon.com)