Polyester slumps as it losses cost and demand support

Polyester chain pricing were seen plunging with cost support almost collapsing while demand hated to rebound as the markets were fundamentally entering the usual off-peak season.

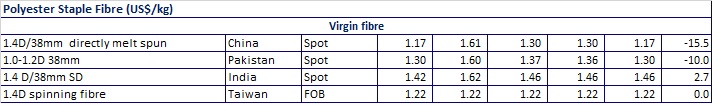

Polyester staple fibre (PSF) prices were cut in China as market sentiment was weighed down by economic uncertainties and heightened US-China trade tensions and softening feedstock cost. Producers took chance to liquidate goods as prices are more likely to fall in general. Fundamentally, polyester apparently entered off-peak season and usually extends from May to July. In China, polyester plants were operating at a reduced rate. May end saw offers dragged down by soft feedstock and thin liquidity, prompting makers to cut run rate further to maintain prices. Most markets succumbed to bearish pressure and sentiment remained soft amid lower offers.

In India, PSF market extended global weakness while producers’ offers rolled over despite rise in raw material cost in domestic markets.

In Pakistan, PSF makers reduced their offers on sharply falling currency.

Polyester spun yarn markets in China succumbed to the fast drifting PSF markets while downstream demand was stable to soft. In India, yarn markets lacked bullish factor, although PSF prices remained unchanged throughout May.

Polyester filament yarn prices declined sharply in China opening the month of May as POY makers started offering big discounts, which resulted in brisk sales. Downstream mills replenished volumes somewhat at lower prices, but overall buying interest remained cautious. Prices nosedived in China in the third week of May in line with the decline in upstream feedstock prices. The markets were generally covered by wait-and-watch stance, seeing downstream mills showing thin buying interest.

In Pakistan, weakening currency prompted sellers of imported goods to adjust offers down to come in line or just below the locally produced goods. By month end DTY offers were raised on costly imports, also prompted local makers to raise their offers.

In India, POY initial offers remained unchanged for May although cost was seen inching up in April. However, market sentiment weakened later and trading atmosphere was dismal, seeing the general elections coming to an end and overall performance was undesirable.