Polyester prices end October plunging and teetering upstream

Polyester prices ended the last week of October (ending 2 November) with prices plunging and rocking the dynamics in the upstream raw material. Players at each level of the polyester chain blamed each other for the downtrend. Raw material makers blamed downstream for the debacle while downstream blamed the upstream for easing cost support. However, the downtrend in polyester prices should ideally be attributed to the waning demand as the peak demand season come to a close.

Polyester filament (PFY) prices nosedived in China as upstream feedstock cost eased dramatically. Local offers were generally cut in various proportion with POYs and FDYs falling rapidly than DTYs. In Pakistan, local DTY prices were stable and were at par with offers for imported goods. Indian PFY offers were generally stable.

Polyester staple fibre (PSF) prices declined to 13 weeks low in China following quick losses in feedstock prices and tepid demand. Domestic markets saw rigid demand while export offers declined on low level discussions. In Pakistan, producers held stable offers and were active to offload goods. In India, producers cut down offers for November, after three months of stable run, amid weak sentiment.

Polyester yarn prices were down in China amid limited sales and upstream PSF cost declining to multi weeks low. However, margins were still high given the slower fall in prices compared to PSF. In Pakistan, polyester yarn prices remained supported by higher prices of imported yarn amid weakness in currency. In India, polyester yarn prices rolled over but had limited room to increase

Back to back firing

Polyester fibre chip markets in Asia were on a weak note and prices declined as producers cut down offers in line with falling raw material cost. In Europe, low season negatively affected demand but producer margins remained intact despite growing expectations for reduced costs. In US, current PET resin price levels is likely to represent the peak for 2018 as the market enters a seasonal low amid a significantly improved supply

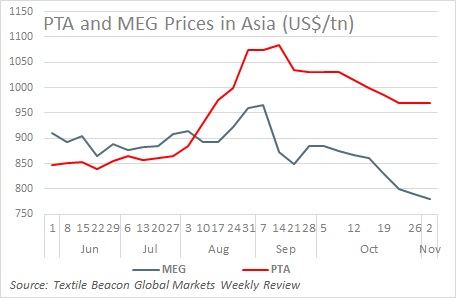

Purified terephthalic acid (PTA) prices dropped in Asia while futures market in China retreated significantly once again. Support from upstream paraxylene also turned weak while processing margin stayed stable. In Europe, October PTA contract decreased in line with lower October paraxylene contract while spot remained unchanged. In US, October contracts were assessed at a rollover. In paraxylene markets, no major settlement for November Asian Contract Price was reached while a partial settlement was heard done. European October contract settled down while spot prices declined. In US, spot prices decreased on declining Asian prices and softening downstream demand.

Mono ethylene glycol (MEG) prices in Asia weakened amid bearish sentiment after crude oil values declined and lackluster sales in downstream polyester industry. In Europe, MEG market awaited October contract settlement, as talks continued. Bulk spot prices slipped further on ample import while truck prices were stable to soft. In US, MEG October contracts settled down while ethylene oxide contract prices for October fell 3.3% on back of decrease in ethylene contract.

Asian ethylene spot prices fell to levels last seen in February 2016 as supply in Northeast swelled and will go up further as steam cracker operators kept operating at high rates. In Europe, spot inched up a bit while November contract settled down due to largely stable feedstock values amid lengthy supply. In US, spot prices rose as higher demand moved the market into a more balanced position. October contracts settled down as cost of ethane eased.

(Source: Global Markets Weekly Review. For full report on polyester prices write to us at sales@textilebeacon.com)