India’s textile production declines for thirteenth month in row, how will it recover?

India’s textile and clothing sector is witnessing signs of recovery and expected to perform better in export and domestic markets this year, said an industry official recently.

Sanjay Jain, chairman, Confederation of Indian Textile Industry (CITI) was quoted saying end-June that, “The sector, which saw a major hit due to demonetisation, implementation of GST, rupee appreciation, and high domestic cotton prices, is finally showing some signs of recovery”.

As recent as on 6 July, the Indian Textiles Accessories and Machinery Manufacturers Association (ITAMMA) said that India is poised to overtake China in the textile sector by capitalizing on factors such as cheaper labour and modernisation and Tamil Nadu will have a major role to play in it. J M Balaji, chairman, stated that India’s textile production was expected to reach a level of US$350 billion from the current US$100 billion. India had the potential to export textiles and apparels worth US$300 billion by 2024-25 from its current US$40 billion, he added.

These statements are in fact very encouraging and promising, but miss ground realities and tend to hide very important facts.

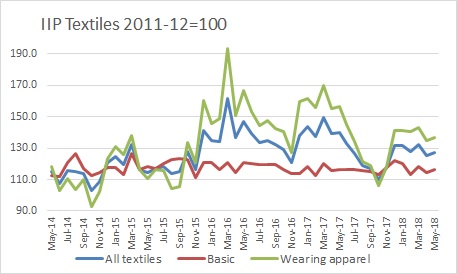

The Index of Industrial production for textile, an official indicator of India’s textile production, shows the opposite. It has consistently declined, year on year, in the past 13 months. So where is the recovery seen to overtake China in next 6-7 years. Putting this in perspective, domestic production in the last 6 years have increased by only 32% until March. So, a 3.5 times increase appear very optimistic and even more the export potential to grow 8 times.

The index has two components, manufacture of textiles and manufacture of wearing apparel with respective weight in total textiles of 71% and 29% respectively. In the overall manufacturing IIP, their respective weights are 3.29% and 1.32%. While the former is more organised than the latter, has shown tremendous increases in 2015-16 and 2016-17 with a peak of 193.2 in March 2016. Since than the index has fallen to 136.8 in May this year. And that is 29% fall in just 26 months.

The numbers appear weird and manipulated since there is no formal collection of data from unorganized sector with garment being the largest.

In May 2018, according to the latest release of Index of Industrial Production data by the CSO, the two components together declined 8.9% year on year. Manufacture of textiles (a larger component) declined 0.5% and wearing apparels by 12.8%. These declines were over and above the fall of 3.2% and 6% in May 2017, when total production declined 4.9%. This only shows that the decline has accelerated instead of rebounding from a fall. Thus, production volumes are significantly lower than their levels in May 2016.

A recovery can only emerge if investment climate improves and income grows. Overall employment generation needs to be accelerated quickly to revive the textile industry. Textile is the first product consumer buy household income increases. Thus it is apparent that textile production is an initial indicator of the health of the economy.