Cotton prices, rain, output and MSP relationship

How will spot cotton prices react to the hike in MSP. The union government on 4 July announced a 28% increase in minimum support price (MSP) for cotton in 2018 kharif season. The MSP for long staple has been fixed at INR5,540

per quintal and INR5,150 a quintal for medium staple. The union budget 2018 has allocated INR7,148 crore to the ministry of textile for the fiscal year 2018-19, as against INR6,251 core in 2017-18 (revised) and INR6,227 crore (budgeted). Allocation for procurement of cotton by Cotton Corporation of India under Price Support Scheme, was pegged at INR924 crore in 2018-19 as against INR303 crore in 2017-18 revised and nil in budget.

Following analysis are based on time series collected from 1991-92 to 2017-18 crop and marketing year on cotton output, rainfall and MSP and cotton spot rates from 2005-06 marketing year.

Cotton harvest

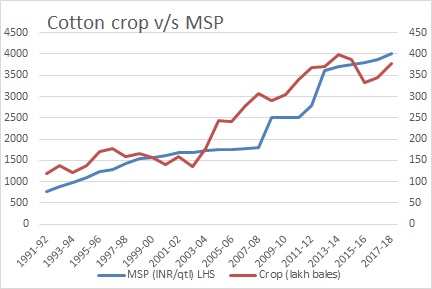

The relationship between MSP and output is disconnect in case of cotton. Two factors are in play. One, the MSP fixation or announcements are made earliest by July-August after the crop is already sown for the season. So, even if the MSP rise is significant, it is redundant because the farmer is unable to take any advantage of the fixation. Two, a very small portion of the crop is bought under Price Support Scheme of CCI. So the benefits in not wide.

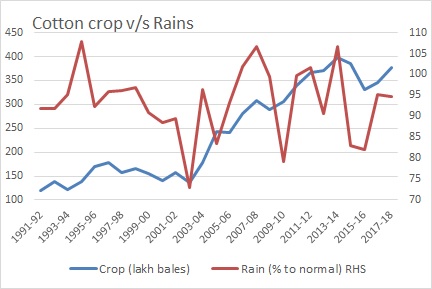

The level of cotton output is mainly the result of the temporal and spatial distribution of the south-west monsoon and availability in irrigation facility. While the latter is more developed in northern States like Punjab and Haryana, it lacks profusely in Maharashtra and Gujarat to some extent, the two major cotton producing states. These state have to depend on rains for a good crop.

Here, if output falls below expectation or the crop is infested by pest, the MSP is secondary. And if the crop is bumper, the MSP comes into play, because spot prices tend to fall in these times.

Spot cotton prices and Crop

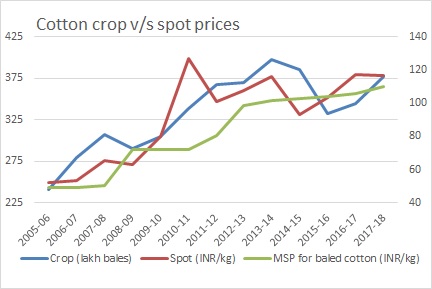

The farmer mostly remembers what remuneration he receives for his crop from the spot market and not the MSP at the time of sowing. Thus, irrespective of MSP and relying more on spot offers, cotton crop is sown and sold by farmers. Also important is the prices of cotton seeds.

Better cotton seed prices also fetch good returns to farmers as one unit of raw cotton contains 62-66% of cotton seed by weight and fibre is only 34-38%. Spot prices move independent of MSP but the market react to MSP fixations as buyers tend to buy cotton just above the MSP in case of normal crop. In case of crop failure, spot is way above the MSP as in case of 2009-10 upto 2013-14 marketing seasons.

In the last 10 years, the spot rate has been lower than MSP levels in 2014-15 and 2015-16 seasons. The earlier such event was in early 2012-13 and full season of 2008-09 when spot prices were ruling was below the MSP levels. During these period, Cotton Corporation of India intervened to procure large quantity of cotton bales from farmer providing remuneration of upto MSP level. In 2008-0, it procured, 89 lakh bales, 23 lakh bales in 2012-13, 87 lakh bales in 2014-15 and 8 lakh bales in 2015-16

Trend in MSP for cotton

The 28% hike in MSP for 2018 cotton crop is apparently government’s hasty move to woo farmers as it prepares to win a second term. The previous big jump in MSP was in 2012 when prices were lifted 23%. Spot cotton prices moved up just 7% in that year. Before that, MSP was raised 44% in 2008 while spot declined 3%. In 2009 and 2010, there were no changes in MSP but spot gained significantly by 26% and 59%, respectively. Spot rates in recent years are being majorly influenced by global prices.

Finally, who is the winner? In case prices fall due to bumper crop, farmers are at loss, and vice versa in case cotton prices move up, consumers bear the cost. Exporters lose the low cost advantage as cotton prices hike distorts market for yarn and textile and thereby the entire value chain.