Cotton yarn export – Why has China reduced buying

Cotton yarn export to China continued to dwindle in September, although it was the top market. During the month, export to China was 16 million kg worth US$39 million. They were lesser by 50% in volume and 58% in value terms this September compared to a year ago.

In continuation to our review of 21 August “Cotton yarn export – What has China reduced buying” now we will take a little more insight into a possible shift in sourcing by China away from India, or they really need less yarns now, or is local produce more competitive than imported goods. Let us decipher pricing related issues here.

In the basket of cotton yarn import from India, 10s, 16s, 20s, 21s, 26s, 30s and 32s account for 90% of all cotton yarns. The majority of spinners in China produce 32s count yarn and this count is also the major count India export to China. Of all the 32s cotton yarn exported from India 85-90% was to China in 2018-19 and April this fiscal. This has come down to 55-65% now.

Among other major counts, China accounts for 40-45% of 20s cotton yarn in 2018-19, has now come down to about 15%. Similarly, share of 26s has fallen from 60-80% to 50%, 10s from 60-70% to 45%. Among finer counts in export basket, about 15-20% of 40s was exported to China, which is now down to less than 10%.

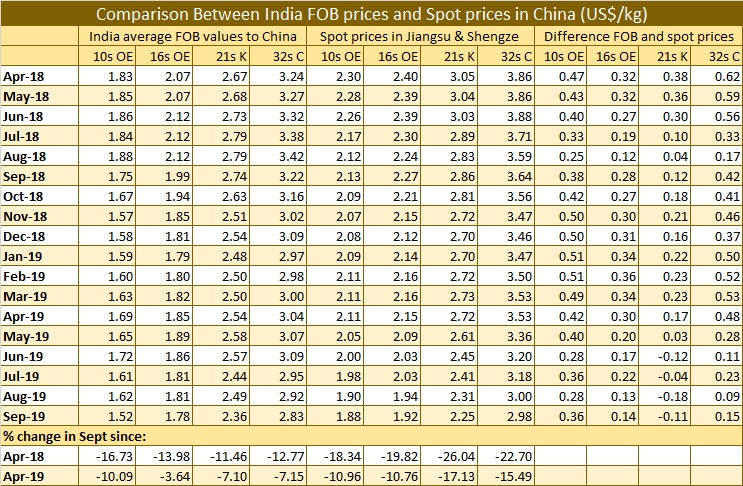

Here, we analyse the movement in India FOB values to China and spot prices in Jiangsu & Shengze markets of China for 10s OE, 16s OE, 21s K and 32s C, since the comparative data is available. In September 2019, FOB prices of 10s fell 17% since April 2018 and by 10% since April 2019. In similar comparison, 16s were down 14% and 4%, 21s carded were down 11.5% and 7% and 32s combed down 13% and 7% respectively.

In China, spot prices movement mirrored the trends seen in India’s FOB values, but more rapidly. Indian export offers are apparently seen to have been adjusted to remain competitive in China’s market. The faster fall in China’s spot prices compared to India FOB, narrowed the gap between the two, beginning from May. This made Indian cotton yarn costlier and local suppliers more competitive.

Moreover, the downturn in Indian cotton yarn export to China coincides with duty free access given for import of cotton yarn into China to countries like Pakistan and Vietnam from 1 April 2019.

The above differences does not include freight, insurance and any duties and spot prices in China including all taxes.