When will textiles tide over this coronavirus crisis – Part 1

Coronavirus attack also named Covid-19 is declared as pandemic and has become a global crisis with more than 160 countries under its grip. Death tolls have been touching new peaks hour by hour and the numbers are compared with previous such events. Results show that this one is really a brutal one. Many countries are under lockdowns, where movement of human is restricted to contain the spread. This in turn has disrupted aggregate demand and demand for textiles in particular. Sales of apparel and clothing have diminished to all historical lows. The moot question is how long this crisis will prevail and more over on textiles. Demand level is the key factor in all crisis, financial or pandemic. Thus, a simple method to tracking the ups and downs in textile demand is the pricing levels. Both demand and supply fundamentals eventually collapse one value – price and that value determines the supply and demand level for any product. More the price collapse, weaker is the demand, and vice-versa.

This time around demand destruction by coronavirus crisis saw prices of all textile raw material and products decline reflecting weakening market fundamentals. But added to this, has been the crude oil price war, and the destruction became more alarming and damaging. Almost all feedstock and fibre intermediate values have touched all time or historical low and are dwindling relentlessly week after week. (For more details on current status please refer to Textile Beacon’s “Global Markets Weekly Review” reports).

The financial crisis of 2007–08, also known as the global financial crisis, was a severe worldwide economic crisis. It is considered by many to have been the most serious financial crisis since the Great Depression of the 1930s. Now coronavirus superimposes the preceding 2007-2008 economic crisis. Prices are falling and recovery in demand not seen on the horizon.

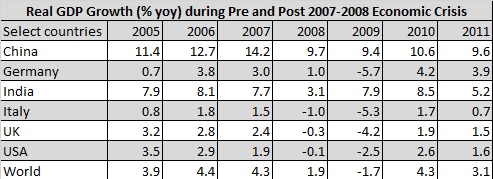

Let us repaint the trends during the 2007-2008 economic crisis, to see how long the current one will prevail, although it is termed more severe. There could some elements which can provide some insight of a possible recovery. It is worth reiterating the scale of that crisis. 2009 became the first on record where global GDP contracted in real terms. The process of responding to the crisis, the subsequent deep recession and the impacts on governance of the global financial system, took the better part of next one decade to implement before there was a reliable return to growth across the US and Europe. During that period, major economies like China and India could defy the gravity to a large extent, while developed economies succumbed posting negative real GDP growth in 2009. World economic real GDP declined 1.7% year on year in 2009. During the same year, GDP declined 2.5% in US, 5.7% in Germany, 4.2% in United Kingdom, and by 5.3% in Italy – the latter is the global fashion capital. China rebutted the decline by growing 9.4% and India by 7.9%. While growth rates are estimated to have declined in US and Europe in the current crisis, even China and India have shown considerable slowdown in their economies. India was already in the slowdown mode for quiet sometime, even before the coronavirus crisis was cultivated.

The next part will decipher the pricing trends in textile during the financial or economic crisis of 2008-2009 and see what is in store in the current situation. Just to recall, the 2008-2009 financial crisis was also cultivated by China.

To be concluded…